Track mileage automatically

Get startedClaim Motor Vehicle Expenses From the CRA In 5 Steps

Using your personal vehicle for business purposes entitles you to a tax deduction regardless of whether you are a self-employed or salaried worker in Canada. If you can prove through accurate records that you utilised your own vehicle for work-related purposes, the Canadian Revenue Agency (CRA) will let you claim these deductions. You must keep meticulous records of the motor vehicle expenses you incur and the mileage you log for business-related activities.

Feel free to use the infographic on your website. Just remember to credit Driversnote with a link to this article.

With Driversnote you can share your mileage log with the CRA or your employer at the touch of a button. Sign up for Driversnote.

Who can claim motor vehicle expenses tax deductions

Here is a list of those who are eligible to claim mileage from CRA:

1. You run a business or are self-employed

People who are self-employed or who own a business and use their car for work can deduct car expenses from their taxable income. The costs must be divided if a taxpayer uses the vehicle for both business and personal use. The deduction is determined by the portion of mileage used for business. You are probably an employee of the company if your business is incorporated. In that case, item 2 below applies to your circumstance.

2. You are an employee

If you meet the following requirements, you can deduct your car expenses:

- Normally, your job needed you to go to other locations or work away from your employer's office.

- Your employment agreement required you to cover all related costs for your vehicle. You are not regarded as having paid your own motor vehicle expenses if your employer reimburses you or if you turn down a fair allowance from your employer.

- A non-taxable allowance for motor vehicle expenses was not given to you.

- Your employer must sign CRA Form T2200, and you should have a copy on hand in case the CRA asks for one.

Track business driving with ease

Trusted by millions of drivers

Automate your logbook Automate your logbook

Automatic mileage tracking and CRA-compliant reporting.

Get started for free Get started for freeMethods of claiming motor vehicle expenses

Full or comprehensive method: a percentage of actual vehicle expenses

The approach to claiming car expenses requires you to keep track of every mile you travel for business in a mileage log and to cover all vehicle costs either directly or through your company.

The percentage of vehicle expenses that are deductible for the year is determined by dividing the number of miles you travel for business purposes each year by the total number of miles you drive.

For instance, if your company spends $5,000 annually on permissible vehicle operating expenses and you drive to work 60% of the time, you can deduct $3,000 from your taxes. The $2,000 in costs related to your personal car use were paid by the company on your behalf and for your benefit; therefore, they are now taxable income to you.

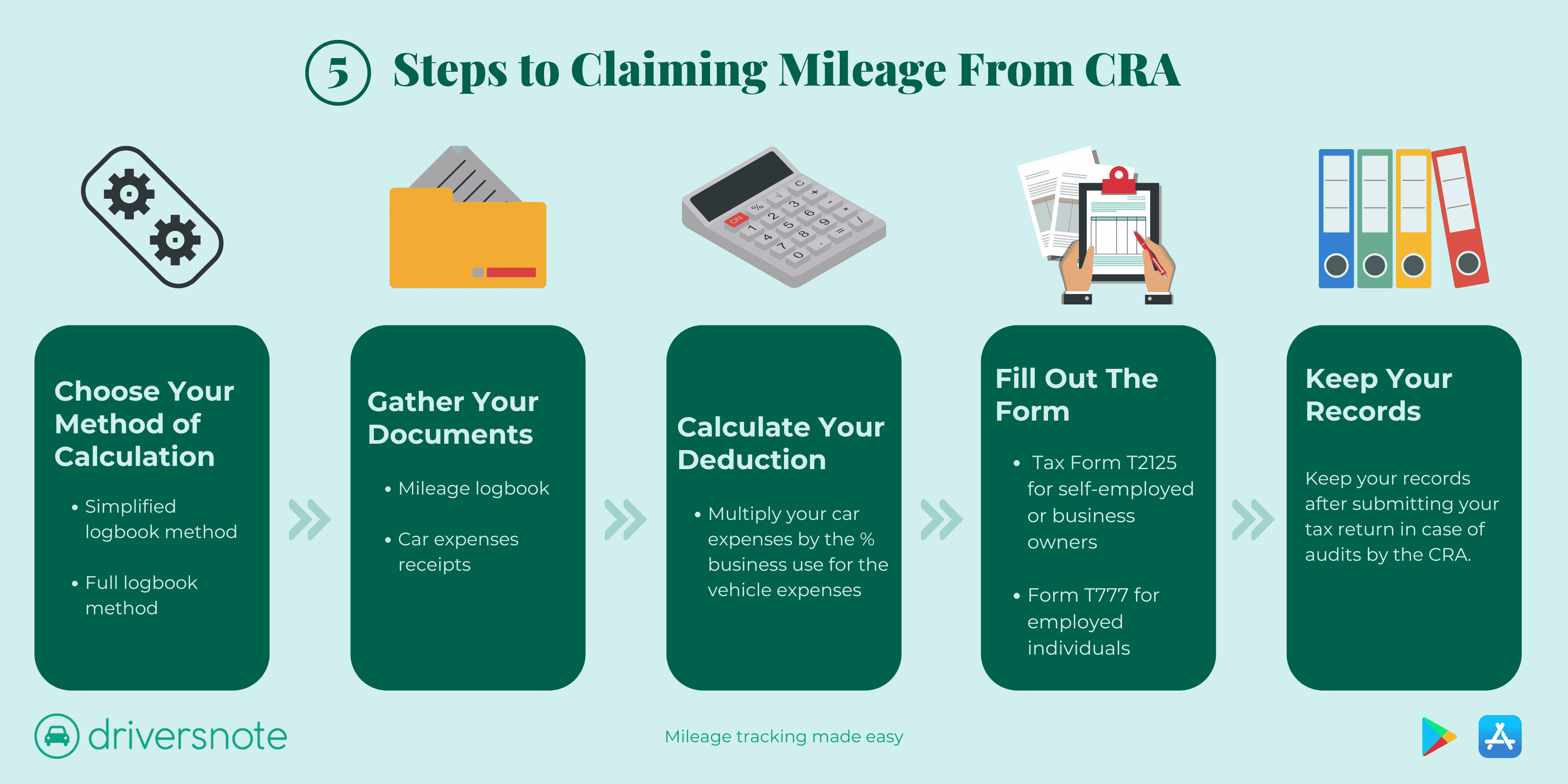

Step by Step: Claiming CRA motor vehicle expenses

Follow the five steps to claim mileage on your taxes each year.

1. Method of calculation

The simple or the full logbook method might apply to you according to your situation, or you may be able to choose. If you can choose which method to use, work out which will provide you with a higher amount you can claim for car expenses, in order to maximise your tax deduction.

2. Gather your documents

Have all documentation ready such as the mileage log (also known as logbook) which is a record of your business travel for the entire year and receipts for all vehicle expense deductions, if applicable.

3. Calculate your eligible deductions

When using the vehicle expenses method, this is computed as - (Business kilometres / total kilometres for the year) X Total motor vehicle expenses = Motor Vehicle Expense Deduction.

4. Fill out the form

To record your mileage deduction for the year, complete "Chart A – Motor vehicle expenses" of Tax Form T2125 (Statement of Business or Professional Activities) for self-employed, or Calculation of Allowable Motor Vehicle Expenses area on Form T777, Statement of Employment Expenses for employees.

5. Keep your records

Keep your your mileage logs and receipts if applicable for six years from submission in case of a CRA audit on your tax return.

Don’t skip on tracking your business mileage

By tracking your mileage, you can save money by claiming it on your taxes. Make it a habit to record the specifics as you go, whether you track your business use of a car in a straightforward paper logbook or a smartphone app. You can choose to keep a manual logbook such as a spreadsheet of your trips or use a fully automated mileage tracking app like Driversnote Mileage Tracker.

FAQ

Tired of logging mileage by hand?

Effortless. CRA-compliant. Liberating.

CRA Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- Mileage Log Requirements

- How To Calculate Mileage Reimbursement

- Is Car Allowance Taxable?

- Claim Motor Vehicle Expenses In 5 Steps

- Current and Historic CRA Mileage Rates

- Historic Mileage Allowance Rates

- Current CRA Mileage Rates