How to automate your mileage log book

Keeping a log book has never been easier. Track your kilometres automatically and quickly create and share your log book for your reimbursement or deductions.

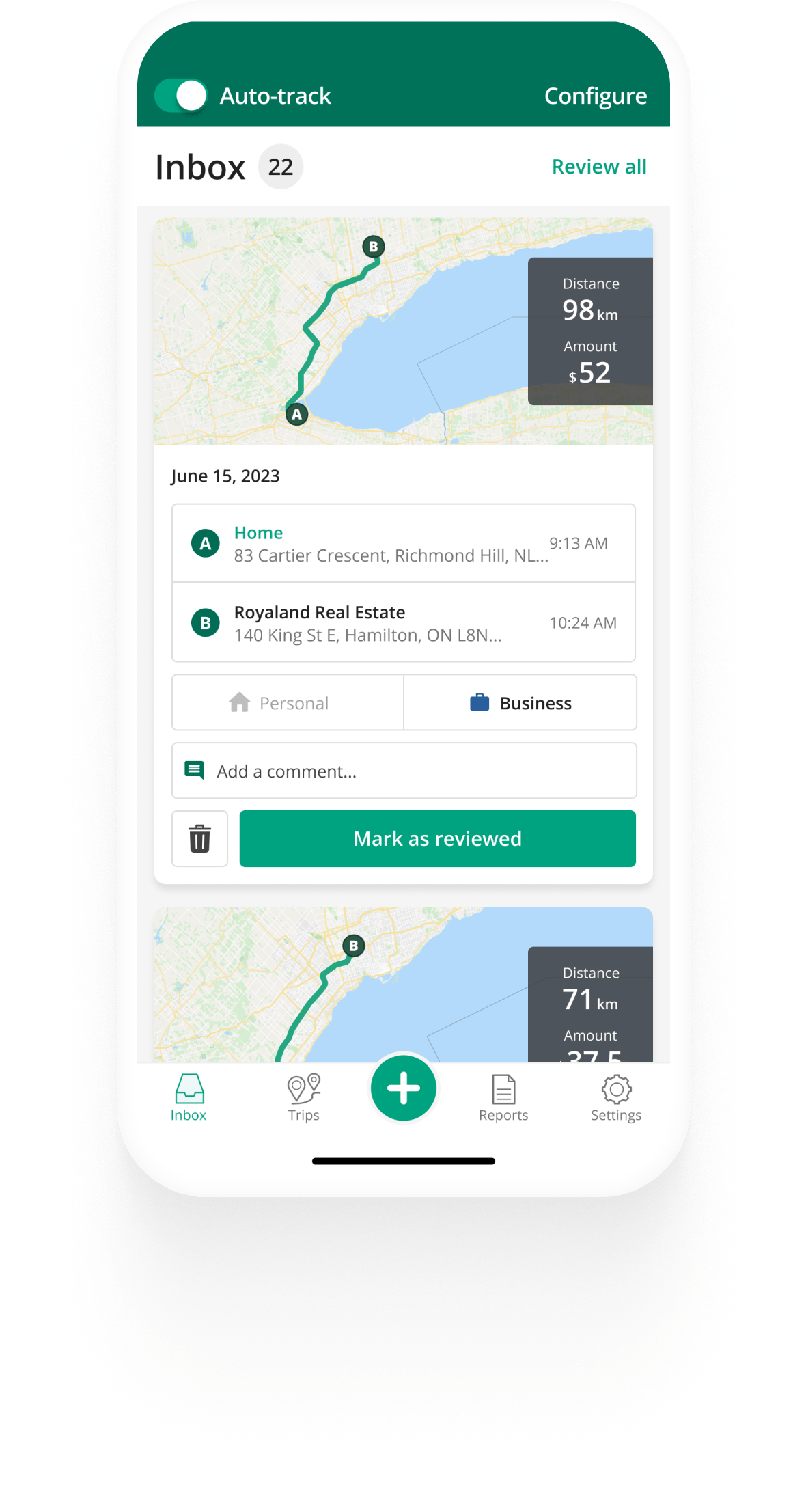

How to automatically track mileage

Mileage tracking made easy

Use the Driversnote mileage log book app to track trips automatically - no need to even open the app. We will log all the required information for you and calculate your reimbursement. You can always add or edit trip details later on.

Read more Sign upIntelligent classification of your trips

Business or Personal?

Stay CRA compliant by logging your mileage under the correct category. Review and classify your trips as Business or Personal in a simple overview. Add your working hours to the app and we will even classify your trips automatically.

Read more Sign upWhat our customers say about us

This app makes tax time easy! Driversnote creates the perfect report to submit to your accountant with all required information and the latest per kilometre rate. Automatic tracking takes the stress out of separating business from personal trips

Absolutely brilliant app. Never had any issues with the Tax department since using DriversNote. Very helpful support staff and an all around great company to deal with.

Seems to be doing a great job of producing a human readable (and spreadsheet exportable) log of my driving, with minimal effort. Thank you for the well designed tool!

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

Simple and easy to use. It takes "it just works" seriously.

looking good so far. auto tracking seems to work well, will turn on pro.features in a week

easy to use

Simple and easy to use. It takes "it just works" seriously.

looking good so far. auto tracking seems to work well, will turn on pro.features in a week

easy to use

Frequently Asked Questions

Record the kilometres driven, time, destination and purpose for each drive in your mileage log book. You must also log your vehicle’s odometer at the start and end of the year. While you can keep a paper vehicle log book, we recommend using a log book app that will automate this process for you.

Calculate your reimbursement simply by multiplying the kilometres driven by the current year’s standard rate, or the rate you are reimbursed at. For example, if you’ve driven 4000 business kilometres this year, and use the CRA mileage rate (61 cents for the first 5000km) the calculation will be the following:

4000 km x 61 cents = $2440 in mileage reimbursement.

If you drive for business purposes, we strongly encourage you to track your mileage with an app! A mileage log book app will help you track all the needed information for your mileage claim and save you the hassle of writing everything down manually. Your CRA-compliant log book will always be just a few taps away.

Get started for free

Never miss a trip

We've got you covered, and it's easy to get started, and even easier to keep going.